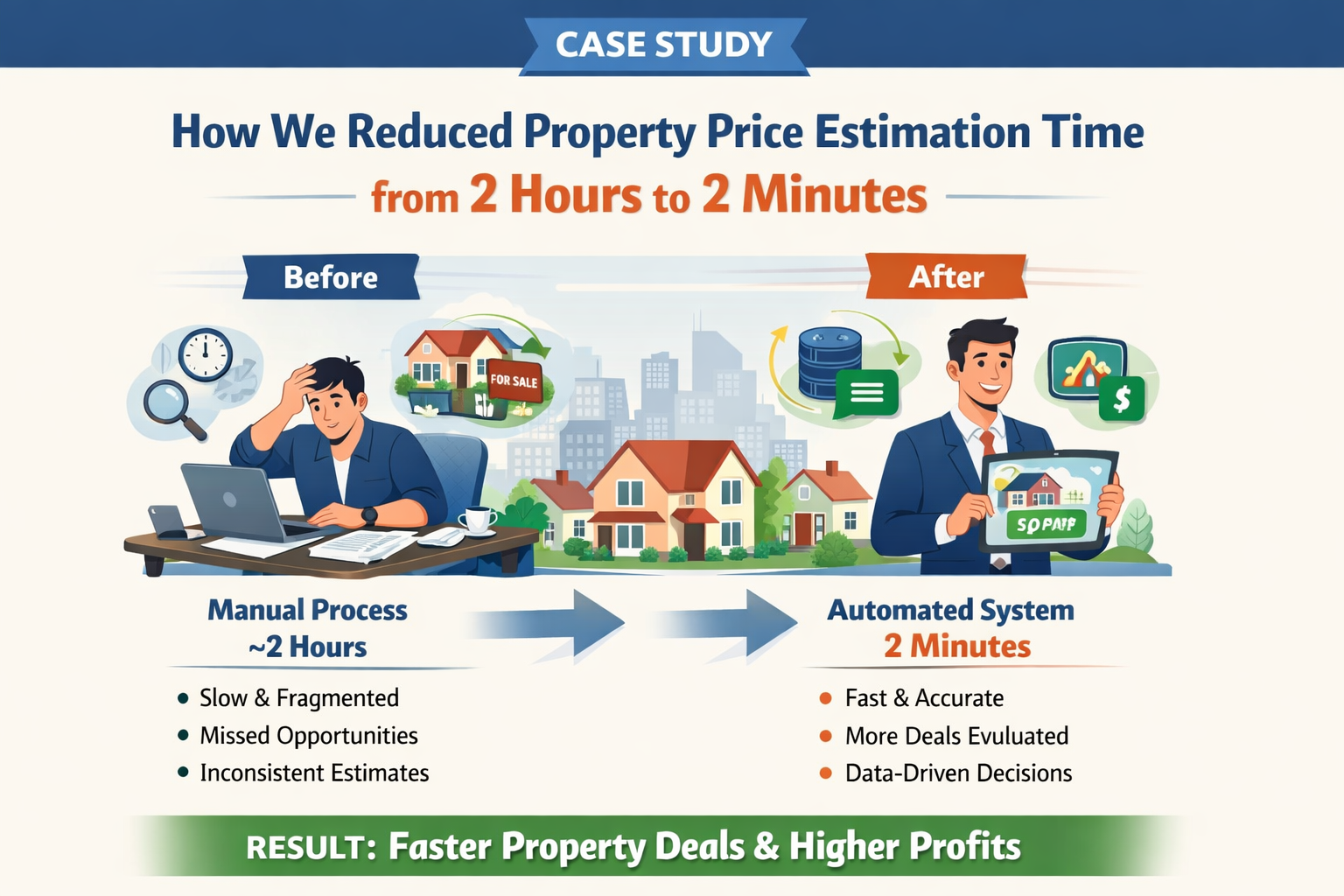

Client Overview

Our client is a property investment and resale company that acquires residential properties, enhances their value, and sells them in the open market. Their business relies on accurate purchase price estimation to ensure strong margins and faster decision-making.

The Challenge

In property investment, buying at the right price determines the outcome of the entire deal. Before working with us, the client’s estimation process was manual and fragmented

- Collecting property and locality data from multiple public sources

- Analyzing comparable properties in the same area

- Evaluating pricing based on size, configuration, and market conditions

- Arriving at a purchase price that left room for value enhancement and resale

Time taken per estimate: ~2 hours

This led to:

- Slower evaluation cycles

- Missed opportunities in competitive markets

- Inconsistent estimates depending on who performed the analysis

The Solution

We developed a centralized, data-driven property estimation system tailored to the client’s acquisition workflow.

What We Built

- A unified platform that aggregates publicly available property and market data

- A smart comparison engine that:

- Identifies similar properties within the same locality

- Applies filters such as area, property type, size, and market behavior

- Automatically generates a recommended acquisition price range backed by data

This allowed the client to quickly determine whether a property met their investment and resale criteria.

How It Works (Process Overview)

- Enter Property Details – Basic inputs such as location and size

- Market Data Aggregation – Relevant public data is pulled automatically

- Comparable Property Analysis – Similar properties are filtered and compared

- Price Range Recommendation – A clear acquisition price range is generated

The Impact

Time Saved:

- From 2 hours to 2 minutes per property

Business Outcomes:

- Faster acquisition decisions

- Ability to evaluate significantly more properties per day

- Reduced risk of overpaying

- More consistent, repeatable estimation process

- Improved confidence in resale margins

Why This Worked

By replacing manual research with an automated system, the client moved from intuition-driven estimates to data-backed decisions, without slowing down their operations.

Key Takeaway

Centralizing data and automating critical decisions can unlock both speed and accuracy in property investment businesses.

This project demonstrates how custom software can directly impact decision velocity, consistency, and long-term profitability